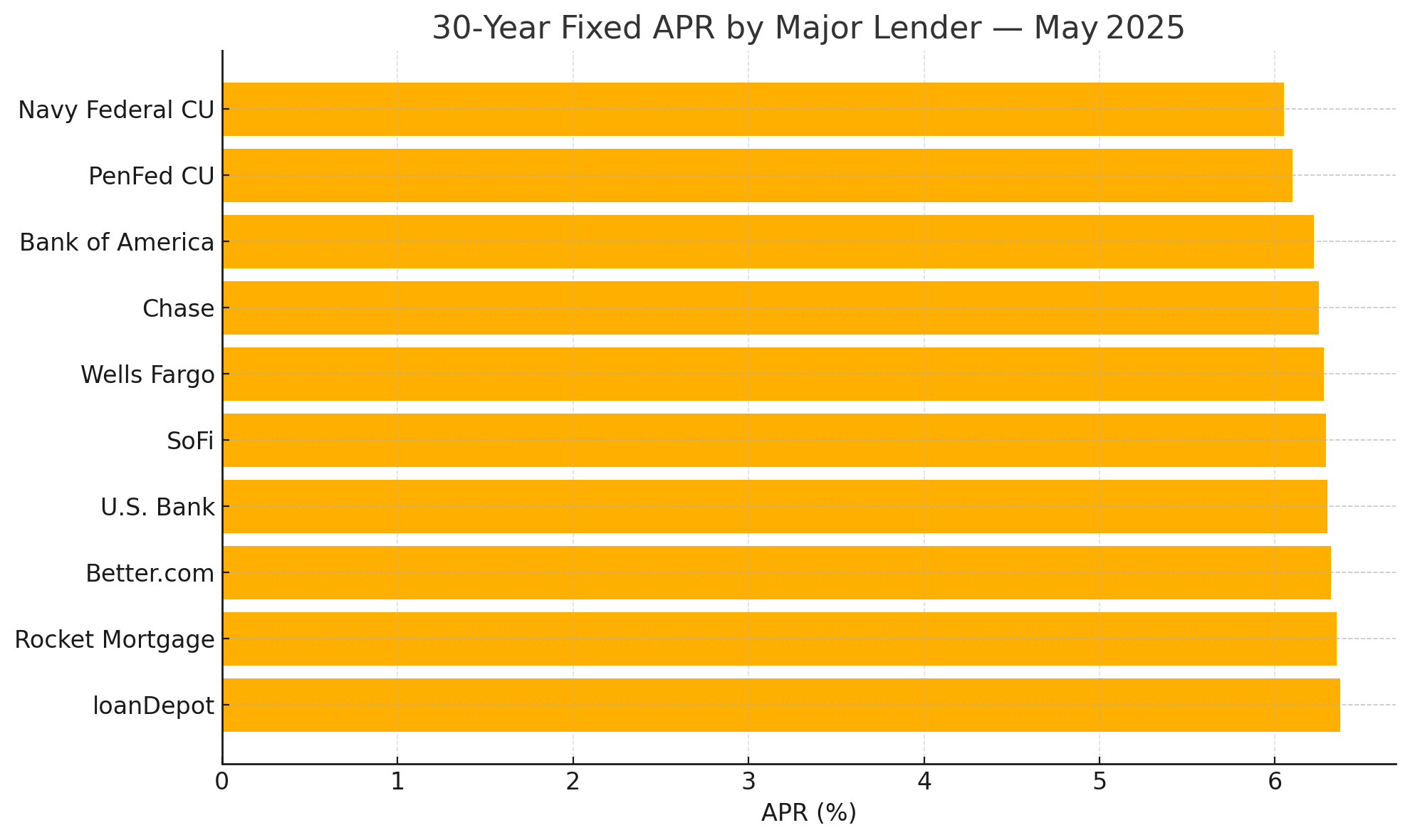

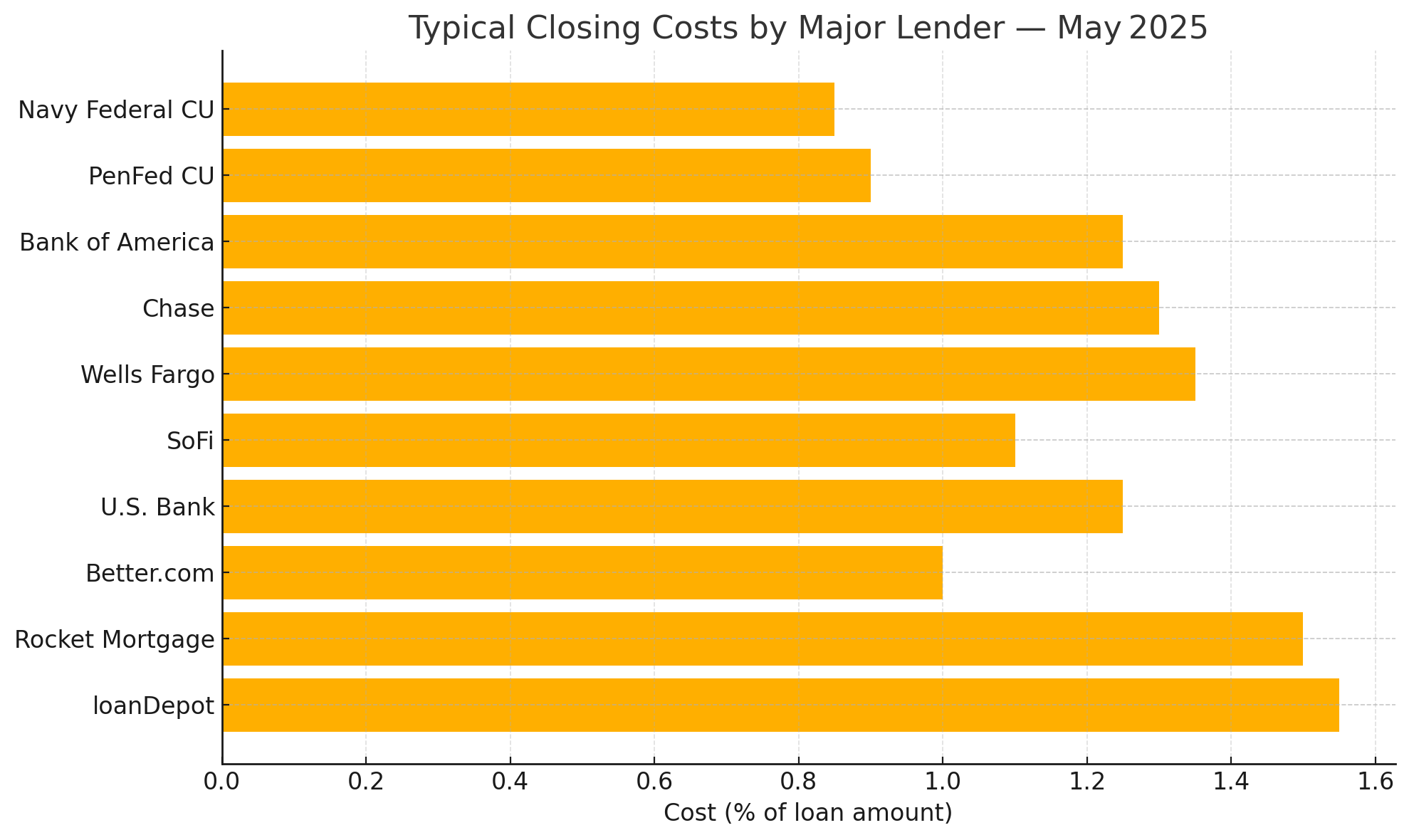

With 30-year fixed rates still hovering near 6 percent, a 0.25-point difference in APR saves about $17,000 in interest on a $350 k loan over 30 years. Add closing-cost variation, and the “cheapest headline rate” is often not the cheapest loan.

Lender-by-Lender Numbers (May 2025)

| Rank | Lender | 30-Yr APR | Closing Costs* | Notes |

|---|---|---|---|---|

| 1 | Navy Federal Credit Union | 6.05 % | 0.85 % | No PMI to 95 % LTV for members. Source |

| 2 | PenFed Credit Union | 6.10 % | 0.90 % | $1 k lender credit on loans $250 k+. Source |

| 3 | Bank of America | 6.22 % | 1.25 % | $600 relationship credit. Source |

| 4 | Chase | 6.25 % | 1.30 % | 0.25 pt rate discount for Sapphire clients. Source |

| 5 | Wells Fargo | 6.28 % | 1.35 % | $500 closing-cost credit for existing customers. Source |

| 6 | SoFi | 6.29 % | 1.10 % | Underwrites to 50 % DTI; rapid digital process. Source |

| 7 | U.S. Bank | 6.30 % | 1.25 % | Competitive jumbo pricing; branch network. Source |

| 8 | Rocket Mortgage | 6.35 % | 1.50 % | 0.75 pt lender credit if you lock within 24 hrs. Source |

| 9 | loanDepot | 6.37 % | 1.55 % | Relatively high origination fee. Source |

| 10 | Better.com | 6.32 % | 1.00 % | No lender fees; lower total cost despite rate. Source |

APRs Side-by-Side

Closing-Cost Spread

Key Take-aways

- Credit unions dominate headline APRs thanks to member-owned, lower-margin models.

- Non-banks advertise aggressively (Rocket, loanDepot) but recoup margin via higher fees.

- Big banks reward loyalty: relationship credits can shave 0.125–0.250 pts—worth factoring into your calculator.

How to Choose the Right Offer

| Factor | Why It Matters | Quick Rule-of-Thumb |

|---|---|---|

| APR vs Closing Costs | A 0.10 pt lower APR ≈ $7/mo on $350 k. If fees exceed 0.25 pt of loan, higher APR may be cheaper short-term. | Use our mortgage calculator; set loan term to 5 years if you expect to move. |

| Rate-Lock Policy | Extending beyond 45 days can add 0.125 pt. | Negotiate a free 15-day extension if builder delays. |

| Pre-payment Penalty | Rare on conforming loans, common on portfolio jumbos. | Avoid any penalty > 1 % of principal. |

| Points Strategy | Buying 1 pt today costs ~2 % of loan; breakeven ≈ 6 yrs. | Buy points only if staying > 7 yrs. |

The true cheapest mortgage in 2025 blends rate, fees, and perks. Credit unions like Navy Federal top the list for APR, while fintechs like Better.com win on low fees. Big-bank relationship discounts can tilt the decision if you already keep assets there.

Next step:

→ Open our mortgage calculator, plug in each lender’s APR and fees from the table above, and see which option costs least over your expected home-ownership horizon.