How to Tell If a Rental Price Is Fair in Today’s U.S. Market

Question

Answer

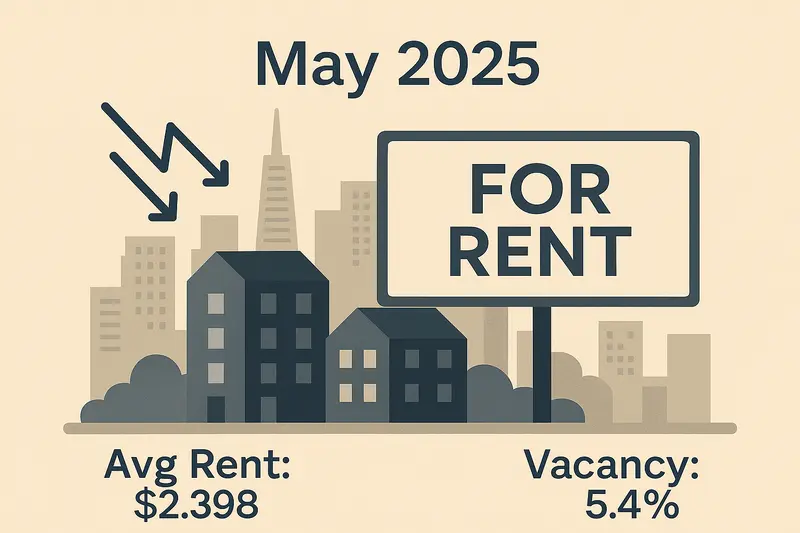

Determining whether a rental price is fair can be tricky, especially in a market where demand, location, and inflation can dramatically shift pricing from one neighborhood to another. A “fair” rental rate is typically one that reflects the current market value of similar properties in the same area, adjusted for features, condition, and amenities.

Fair market rent is generally defined as the amount a landlord could reasonably expect to charge based on comparable listings nearby. It’s not an arbitrary number — it’s influenced by factors such as location, property type, size, and rental demand. Even the time of year can impact rental prices in some cities.

To assess if a rental price is fair, consider the following:

- Compare with similar listings: Check platforms like Zillow, Rent.com, or Apartments.com to see what similar units in the area are renting for. Look for properties with comparable square footage, number of bedrooms, and amenities.

- Review HUD’s Fair Market Rent data: The U.S. Department of Housing and Urban Development (HUD) publishes annual Fair Market Rent estimates by county and metro area. While designed for housing assistance programs, they can be a helpful benchmark.

- Consider utilities and included services: Some rentals include water, trash, or even electricity or Wi-Fi. A slightly higher rent might still be fair if those costs are bundled in.

- Evaluate the lease terms: Month-to-month rentals often cost more than longer-term leases. A shorter lease or flexible terms may justify a premium.

- Check rent increase history: If renewing a lease, review past rent increases. In many states, landlords must provide notice (e.g., 30 or 60 days) for significant hikes. Some cities also have rent control or rent stabilization laws that limit increases.

As a general rule, many renters aim to spend no more than 30% of their monthly income on housing. However, in high-demand cities like New York or San Francisco, market realities can push that percentage higher.

Red flags for unfair pricing include drastic differences from comparable listings, unusually high fees, or a lack of transparency about what's included in the rent. If something feels off, trust your instincts and do more research.

In conclusion, what’s “fair” will always depend on the local market and personal circumstances. Before signing a lease, it's wise to review recent comparables and, if needed, consult a local real estate professional — especially in areas with complex regulations or fast-changing rental trends.